HR 101: What Not to Write in Personnel File After Employee Files EEOC Complaint

The human resources manager for the defendant in the recent Texas Court of Appeals case of A&L Industrial Services, Inc. v. Oatis, apparently never took this course. Largely because of his actions, the plaintiffs—former employees who were terminated—were able to convince a jury not only that they were retaliated against for complaining about discrimination, but also that they were entitled to punitive damages. What is somewhat surprising is that the appellate court upheld these findings in spite of the fact that the plaintiffs failed to prove their underlying discrimination claim.

To find out what happened, click here, and you will be taken to my post on our firm’s website.

Giddyup! Horseback Rider Survives Injury (and Ranch’s Summary Judgment Motion)

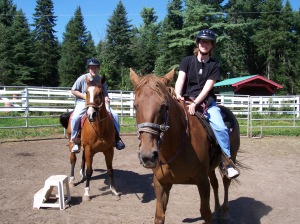

Year after year, no matter where we went for vacation, we always seemed to drive by a ranch offering trail rides. Finally, after many years of declining such requests, my wife finally convinced me to give it a try. We were vacationing in the Adirondacks and I owed it to my wife to finally give horseback riding a try.

Earlier in the week, I went overboard with the mountains we climbed–choosing in mid-hike to add another nearby mountain to our trek before returning to the car. Suffice it to say, this made it easier for my wife to convince me to finally go on my first trail ride.

While the trail ride proved to be a fun experience (and I’ve been riding a few times since then), I was pretty nervous about being that high up on unfamiliar trails. I also remember the guide giving us a short pre-ride lesson, and while he was sitting on his horse, it stepped back and tripped on the small step ladder he used to get on the horse. This only served to heighten my anxiety, as I already had Christopher Reeve on my mind, and now I watched our guide nearly fall off his horse. But we made it without any other mishaps.

By now, you’re probably thinking, “What does this story have to do with the injured horseback rider you mentioned earlier?” I am pretty sure that the ranch where I first rode was the Emerald Springs Ranch in Saranac Lake (how many other ranches could there be in Saranac Lake?). So when I saw a case about an injured horseback rider suing the Emerald Springs Ranch I knew I had to write about it.

In Vanderbrook v. Emerald Springs Ranch, 109 A.D.3d 1113, 971 N.Y.S.2d 754 (4th Dep’t 2013), the horseback rider sued the Ranch, seeking damages for personal injuries she sustained while riding a horse on a guided trail ride at the Ranch. During the ride, the horse brushed up against a tree, plaintiff was unable to push away from the tree, and the tree caught plaintiff’s leg, allegedly injuring her leg and hip.

The Ranch moved for summary judgment, asking the trial court to dismiss the complaint as a matter of law because, according to the defendant, the plaintiff could not establish either (1) the horse’s “vicious propensity” or (2) that the Ranch was aware of such “vicious propensity.” How could a horse have a vicious propensity? Should be pretty easy, right?

Not exactly. As the court noted, “It is well settled that the owner of a domestic animal who either knows or should have known of that animal’s vicious propensities will be held liable for the harm the animal causes as a result of those propensities.” [Vanderbrook, 109 A.D.3d at __, 971 N.Y.S.2d at 755 (internal quotations omitted)]. “[A]n animal that behaves in a manner that would not necessarily be considered dangerous or ferocious, but nevertheless reflects a proclivity to act in a way that puts others at risk of harm, can be found to have vicious propensities–albeit only when such proclivity results in the injury giving rise to the lawsuit.” [Id. (internal quotations omitted)].

In an effort to convince the court that the complaint should be dismissed, the Ranch submitted proof establishing that the rider herself testified that she was in fact instructed by Ranch personnel to push off the trees if the horse walked too closely to the trees on the single-track trail. The Ranch bolstered this proof with the transcript of the Ranch owner’s deposition, in which she also stated that she told her guides to instruct riders to push off the trees of the horses rode too closely to them. The Ranch obviously thought this proof would support its arguments. But the court instead found that this proof instead illustrated a question of fact to be determined at trial as to whether the Ranch knew of the horse’s propensity to walk too closely to the trees, which was the behavior that allegedly caused the rider’s injury.

The court also ruled that the Ranch failed to establish as a matter of law that the rider assumed the risk of horseback riding. “Assumption of the risk” is a defense often successfully asserted in recreational injury cases. However, as the court noted here, “Horseback riding participants will not be deemed to have assumed unreasonably increased risks.” [Id. (internal quotations omitted)]. According to the court, the Ranch’s evidence again raised questions of fact as to whether the Ranch unreasonably increased the risks of horseback riding by using a bitless bridle on their horses, which allegedly failed to provide plaintiff with the ability to control the horse, and by failing to give the plaintiff, who was a novice rider, adequate instruction on how to control the horse. When looking at the pictures of my first ride, I noticed that the bridle on my horse also appeared to be bitless.

Finally, the Ranch also sought dismissal of the complaint based on the waiver of liability that the rider signed before the ride. The court ruled that the Ranch failed to establish any entitlement to dismissal on this ground as well, finding that the release here was void as against public policy based upon General Obligations Law section 5-326. Although it is a common practice to ask participants to sign waivers like this before engaging in certain recreational activities, many (but not all) of these releases have been rendered void by this provision of the General Obligations Law. The issues presented by such releases are beyond the scope of this post, and I plan to write about that in a future post.

So what happens next? In all likelihood, the case will be scheduled for a trial. Although the injured rider survived the Ranch’s motion for summary judgment, this only means that she was able to convince the judge that factual issues exist, warranting a trial. Absent a settlement of the claim, she now must convince a jury that she is entitled to recover.

NYS Comptroller to Fire Districts: Bond Credit Card Users

Some of you know that I represent a number of fire districts in and around Monroe County. I have found that one of the best resources for fire district commissioners is the New York State Comptroller’s website. The website has a lot of useful information, as noted in a prior post. From time to time, I peruse the latest audit reports available on the website, looking for issues that other districts have faced, so I can advise my clients about these developments and assist the commissioners in carrying out their duties.

When reviewing the latest batch of audits from the New York State Comptroller’s Office, I saw only one audit of a fire district. Although there were no major criticisms noted, I did take note of a recommendation from the auditors that I wanted to pass along to you.

In this latest fire district audit, the auditors found:

- The Board-adopted credit card policy authorizes issuing credit cards to certain District officials. The policy states that each credit card purchase is limited to $2,500 and must be documented by submitting a receipt which specifies the purchase date, amount, location, reason, item description, and the purchaser’s name. However, this policy does not require bonding insurance for all individuals who are issued District credit cards. We found that the only individual bonded was the Treasurer.

Therefore, the auditors recommended that the board of fire commissioners amend the district’s credit card policy to require the provision of bonding insurance for any board member, official or employee responsible for using credit cards. Although I have not seen a specific statutory requirement mandating bonding insurance here, I do think this is a good recommendation if you are going to permit district personnel to use credit cards issued to the district. If you are a fire district commissioner and would like discuss this issue further, or if you would like to know more about the services provided by our firm, please visit the municipal page of our firm website. You may also contact me directly by clicking the “contact” tab above.

Court Dismisses Snow and Ice Slip and Fall Case

I just took the dog out, and discovered that it is snowing! Is it really that time of year already? I still have some leaves to rake. I guess I’ll have to put the rake away and get the shovel out.

Earlier today, I was reviewing recent decisions from the Appellate Division, Fourth Department, and I came across a case that I thought would be the good subject for a post coinciding with the first snowfall. I just didn’t think I’d be writing this post today!

The case of Glover v. Botsford, 108 A.D.3d 1182 (4th Dep’t 2013), was brought by a woman seeking damages for injuries she sustained when she slipped and fell on snow or ice on the sidewalk in front of a store owned by one of the defendants and operated by another within the City of Rochester. The plaintiff alleged that the defendants were negligent because they either created the dangerous condition outside of their store or failed to remedy the condition despite actual or constructive notice of it. Following discovery, the defendants moved for summary judgment, seeking dismissal of the complaint. The defendants alleged that they had no duty to remove the snow and ice from the sidewalk because there was a storm in progress at the time of the accident. However, Justice Polito denied the motion, having determined that there was an issue of fact as to whether the defendants “properly maintained the dangerous, slippery condition by removing the snow, but not salting or removing the ice, as alleged.”

The Appellate Division reversed, based primarily on the affidavit of defendants’ expert meteorologist, and the weather reports upon which that expert relied. According to the court, this evidence established as a matter of law that there was a storm in progress at the time of the accident.

In opposition to the motion, plaintiff relied exclusively on an affirmation from her attorney, “who asserted, based on an inaccurate reading of the weather reports submitted by defendant that it was not clear whether it had been snowing at the time of the accident.” Parenthetically, I note that earlier today I read a post on the American Bar Association website, discussing a case by U.S. Court of Appeals Judge Richard Posner, who heavily criticized attorneys for being “afraid of math” and the sciences, and one wonders if this case provides further evidence in support of Judge Posner’s argument?

In any event, the Fourth Department noted that:

Even assuming, arguendo, that it was not snowing heavily at the time of the accident, we note that the ‘storm in progress doctrine is not limited to situations where blizzard conditions exist; it also applies in situations where there is some type of less severe, yet still inclement, winter weather.’

The court also noted that the plaintiff failed to establish that there was any sort of “lull” or “break” in the storm such that the defendants would have had a reasonable amount of time to abate the slippery conditions.

The court also held that the plaintiff failed to raise an issue of fact as to whether the defendants created the dangerous condition or whether their snow removal efforts made the condition worse. The court noted both that:

- The mere failure to remove all snow and ice does not constitute negligence and does not constitute creation of a hazard; and

- The failure to salt or sand a sidewalk does not constitute an exacerbation of a dangerous condition.

Cases like this can be challenging, and not every accident is the result of someone else’s negligence. However, if you or a loved one are seriously injured and have questions about whether or not a claim exists, feel free to contact me. Since its founding in 1979, our firm has represented many clients who were seriously injured by the negligence or wrongful conduct of others. We would be happy to help you.

Another Reason to Exercise Care With E-Mail

An appellate court in New York recently decided a case that serves as yet another reminder to be careful when sending an email. In Forcelli v. Gelco Corp., 109 A.D.3d 244 (2d Dep’t 2013), the Appellate Division, Second Department, held that an email message satisfied the statutory criteria for a binding and enforceable stipulation of settlement. While it is not surprising that parties can form a contract by email, it is somewhat surprising that the court here held that, under the facts of this case, an email constituted a stipulation of settlement in the absence of a handwritten signature.

An appellate court in New York recently decided a case that serves as yet another reminder to be careful when sending an email. In Forcelli v. Gelco Corp., 109 A.D.3d 244 (2d Dep’t 2013), the Appellate Division, Second Department, held that an email message satisfied the statutory criteria for a binding and enforceable stipulation of settlement. While it is not surprising that parties can form a contract by email, it is somewhat surprising that the court here held that, under the facts of this case, an email constituted a stipulation of settlement in the absence of a handwritten signature.

In Forcelli, a personal injury action arising out of a multi-party automobile accident, the plaintiff’s attorney and the insurance adjuster reached an agreement regarding settlement following an unsuccessful mediation involving all the parties. After agreeing on the amount of the settlement, the adjuster sent an email to plaintiff’s attorney, confirming that the plaintiff’s attorney accepted the adjuster’s offer of $230,000 during their telephone conversation, and further noting that the parties agreed that the plaintiff’s attorney would have his client sign the medicaid form and a general release and stipulation of discontinuance.

The next day, the plaintiff signed the release, but before it was forwarded to the insurance adjuster, the trial court granted the defendants’ motion for summary judgment, which resulted in the dismissal of the plaintiff’s complaint. When the defense attorney learned that the settlement papers had been received by the insurance adjuster, the defense attorney sent a letter to the plaintiff’s attorney rejecting the settlement papers, claiming that there was no settlement consummated between the parties in accordance with the statutory requirements for stipulations of settlement. Thereafter, the plaintiff’s attorney filed a motion, seeking to vacate the summary judgment order of dismissal. That motion was granted, resulting in this appeal.

Where a settlement is not made in open court, the civil practice law and rules provide that a settlement agreement will not be binding “unless it is in a writing subscribed by [the party] or his attorney.” Also, since settlement agreements are subject to the principles of contract law, all material terms must be set forth and there must be a manifestation of mutual assent in order for the agreement to be enforceable.

After noting that courts have “long recognized that traditional correspondence can qualify as an enforceable stipulation of settlement”, the Appellate Division discussed the issue of whether an email could be “subscribed” because it cannot be “signed in the traditional sense.” In analyzing this issue, the court first noted that two other departments have held that emails could constitute signed writings satisfying the requirements of a stipulation of settlement. The court then observed that “given the now widespread use of email as a form of written communication in both personal and business affairs, it would be unreasonable to conclude that email messages are incapable of conforming to the criteria of [the civil practice law and rules] simply because they cannot be physically signed in a traditional fashion.” Finally, after noting that this conclusion is buttressed by reference to the New York State Technology Law, the court held:

[W]here, as here, an email message contains all material terms of a settlement and a manifestation of mutual accord, and the party to be charged, or his or her agent, types his or her name under circumstances manifesting an intent that the name be treated as a signature, such an email message may be deemed a subscribed writing within he meaning of [the civil practice law and rules] so as to constitute an enforceable agreement.

However, one factor that the court considered here was the fact that the insurance adjuster ended with the expression “Thanks,” followed by the insurance adjuster’s full type-written name. The court noted that, “This indicates that the author purposefully added her name to this particular email message, rather than a situation where the sender’s email software has been programmed to automatically generate the name of the email sender, along with other identifying information, every time an email message is sent.” Thus, whether or not there is a subscribed writing in a future case may very well depend on whether the author actually typed his or her name, or simply used an automatically-generated email “signature.”

As I read about this case, I couldn’t help but wonder how far we’ve come from the days of wax seals. Now, you do not even need an actual hand-written signature for a subscribed writing. But, I still like the custom-made dojang that my wife brought me back from her trip to Korea last summer. These are “seals” often affixed to official documents in Korea. If you look closely in the picture above, you can see my name carved in the seal, along with what I believe to be my name written in Hangul. Too bad I won’t need it to confirm any stipulations of settlement.

As Senate Debates ENDA, New York’s Sexual Orientation Non-Discrimination Act Celebrates its 10th Year

On the drive home this evening, NPR reported that the U.S. Senate had just voted to move forward with debate on the Employment Non-Discrimination Act, which would expand the protections afforded under Title VII of the Civil Rights Act of 1964 to prohibit discrimination based on sexual orientation or gender identity. Although the bill faces an uncertain future in the House (it was reported that the Speaker came out against consideration of the bill), many states already have laws prohibiting discrimination against LGBT people. But many do not.

On the drive home this evening, NPR reported that the U.S. Senate had just voted to move forward with debate on the Employment Non-Discrimination Act, which would expand the protections afforded under Title VII of the Civil Rights Act of 1964 to prohibit discrimination based on sexual orientation or gender identity. Although the bill faces an uncertain future in the House (it was reported that the Speaker came out against consideration of the bill), many states already have laws prohibiting discrimination against LGBT people. But many do not.

New York is one of the states that enacted such protections. The New York Sexual Orientation Non-Discrimination Act (“SONDA”) was signed into law by Governor George Pataki on December 17, 2002, and the law became effective on January 16, 2003. An easy-reader summary of SONDA and its protections may be found in a brochure on the New York State Attorney General’s Website. Additional information may be found on the website for the New York State Division of Human Rights.

Although part of my practice involves representation of both employers and employees in discrimination cases, in the decade since the SONDA was enacted, I can count the number of cases I’ve handled involving an allegation of discrimination based on sexual orientation on one hand. By far, the vast majority of cases I’ve handled over the years have involved allegations of discrimination or harassment based on race, gender or disability. But, that doesn’t mean that statutes like SONDA are not needed, and in time, we may soon see a day when the protections of the ENDA are the law of the land.