Home » Personal Injury

Category Archives: Personal Injury

Appellate Division Holds Arm Wrestling Outside Scope of Employment

Image by Ryan McGuire from Pixabay

From time to time, a case in the Advance Sheets piques my curiosity. Gehrke v. Mustang Sally’s Spirits and Grill, Inc., __ A.D.3d __, 2020 NY Slip Op. 00741, is one of them.

As the trial court noted in her decision denying summary judgment: “This is an arm wrestling in a strip club case.” I did not know there were such cases, but apparently there are, and this is one of them. I was curious about why someone would pursue such a case to begin with, let alone pursue an appeal, and I ended up looking up the appellate record online to find out more about this case.

The plaintiff was a regular at “Tiffany’s Cabaret,” and one afternoon after about three hours of drinking, he talked the bartender into arm wrestling. After about ten seconds, there was a “pop” and his arm went limp. The bill of particulars indicates that he had a displaced right humeral shaft fracture, requiring surgery and hardware to repair. In other words, he broke his funny bone. But, the injuries were not funny. A displaced fracture requiring surgery is no laughing matter.

Plaintiff asserted a cause of action for negligence based on theories of respondeat superior and premises liability. Respondeat superior is a legal doctrine whereby an employer is liable for the negligent acts of his or her employee if the acts occur within the scope of employment. “Tiffany’s Cabaret” moved for summary judgment, seeking dismissal of the complaint on both theories of liability, claiming that its employee was acting outside the scope of employment at the time of the incident and also claiming that it did not owe plaintiff a duty of care under the theory of premises liability.

The trial court denied the Cabaret’s motion on both grounds, holding that it owed its customer a duty of care on the premises liability claim, and determining that factual issues exist on the respondeat superior claim. The trial court also noted that, if a jury found the arm wrestling to be within the scope of the bartender’s employment, “a notice requirement is obviated because, per respondeat superior, Defendants created the alleged dangerous condition of arm wrestling.”

The Appellate Division reversed on the respondeat superior issue. While noting that it is generally a question for the jury whether an employee is acting within the scope of employment, “an employer is not liable as a matter of law under the theory of respondeat superior ‘if the employee was acting solely for personal motives unrelated to the furtherance of the employer’s business.'” Id. (quoting Mazzarella v. Syracuse Diocese, 100 A.D.3d 1384 (4th Dep’t 2012)). The Appellate Division concluded that the defendant established that the employee’s act of arm wrestling plaintiff was not within the scope of his employment and that plaintiff failed to raise a triable issue of fact in response.

The Appellate Division also reversed on the premises liability issue, resulting in the dismissal of the complaint in its entirety.

There are perhaps several morals of this story, and I will let you draw your own conclusions about that. But, one thing I would like to point out to my readers is that this case demonstrates that not all serious injuries are the result of actionable negligence. It is unfortunate that the plaintiff broke his arm. But, Tiffany’s Cabaret was not legally responsible for causing this injury.

Part of my practice has included representation of plaintiffs seriously injured by the negligence of others. In fact, the very first case I was assigned when I started as a new associate with the firm 24 years ago was a premises liability case where a little boy was injured in a fall through a wide-open stairwell in an elementary school. Before we decide to take any personal injury case, we consider not only the nature of the injuries, but also whether or not somebody else’s wrongful conduct caused the injuries.

Did you know? Since our firm began in 1979, we have represented clients seriously injured by the negligence or intentional misconduct of others, whether involving motor vehicle accidents or other wrongful conduct. As noted above, this has also been part of my litigation practice since I joined the firm in 1996. If you or a someone you know is ever seriously injured by another person’s carelessness, you can always contact us to talk about your rights and available options. Information about our Personal Injury Practice may be found here. Hopefully, you’ll never need us for that.

This publication is intended as an information source for clients, prospective clients, and colleagues and constitutes attorney advertising. The content should not be considered legal advice and readers should not act upon information in this publication without individualized professional counsel.

Are you responsible for injuries caused by a distracted driver who crosses the center line and collides head-on with another vehicle while texting with you?

Courts have held that a passenger in a car may be liable if he or she distracted the driver while operating the vehicle immediately before an accident. Does such liability extend to a person sending text messages to a person whom he or she knows is operating a motor vehicle immediately before an accident? Earlier this month, the Appellate Division answered this question in a case of first impression in the State of New York [Vega v. Crane, ___ A.D.3d. ___, 2018 NY Slip Op 03262 (4th Dep’t 2018)].

On a dark, rainy night in December 2012, Carmen Vega and Collin Crane were driving their vehicles toward each other on Route 33 in Genesee County. Mr. Crane was driving home from work and was exchanging text messages with his girlfriend, Taylor Cratsley. As the vehicles approached each other, Mr. Crane’s vehicle crossed the center line and the two vehicles collided, killing Mr. Crane and seriously injuring Ms. Vega.

The New York State Police determined that the primary cause of the accident was Mr. Crane’s failure to keep to the right of the center line. According to the accident reconstruction report, there was no evidence that Mr. Crane tried to take evasive action, suggesting that he was likely distracted. The investigator concluded that the cellular phone activity “may have been the source of this distraction.”

Ms. Vega commenced a lawsuit arising out of the accident, and included a claim against Ms. Cratsley, “alleging that the collision was caused in part by her negligence in continuing to engage [Mr. Crane] in a text message conversation despite knowing, or having special reason to know, that he was operating a motor vehicle.”

The trial court granted Ms. Cratsley’s motion for summary judgment, dismissing the complaint against her, and Ms. Vega appealed. The Appellate Division affirmed, holding that:

[A] person does not owe a common-law duty to motorists to refrain from sending a text message to a person whom he or she knows, or reasonably should know, is operating a motor vehicle.

In rendering its decision, the Court noted “a significant distinction between the distracting passenger and the remote sender of text messages.” The Court reasoned that a driver cannot prevent the passenger–who is actually inside the vehicle–from creating a distraction. However, the same driver “has complete control over whether to allow the conduct of the remote sender to create a distraction.”

It is the driver who has the duty to see what should be seen and to exercise reasonable care in the operation of his or her vehicle to avoid a collision with another vehicle.

If a person were to be held liable for communicating a text message to another person whom he or she knows or reasonably should know is operating a vehicle, such a holding could logically be expanded to encompass all manner of heretofore innocuous activities. A billboard, a sign outside a church, or a child’s lemonade stand could all become a potential source of liability in a negligence action. Each of the foregoing examples is a communication directed specifically at a passing motorist and intended to divert their attention from the highway.

Finally, in reviewing the various laws passed to regulate cellular telephones and other electronic devices by those operating motor vehicles, the Appellate Division noted that in passing these laws, the legislature did not create a duty to refrain from communicating with persons known to be operating a motor vehicle. Instead, “those laws place the responsibility of managing or avoiding the distractions caused by electronic devices squarely with the driver.”

Did you know? Since our firm began in 1979, we have represented clients seriously injured by the negligence or intentional misconduct of others, whether involving motor vehicle accidents or other wrongful conduct. This has also been part of my litigation practice since I joined the firm over 20 years ago. If you or a someone you know is ever seriously injured by another person’s carelessness, you can always contact us to talk about your rights and available options. Information about our Personal Injury Practice may be found here. Hopefully, you’ll never need us for that.

SUM Good News About Auto Insurance

How’s your SUM coverage?

For for many years, I told clients, friends, and family–really anyone who would listen–to be sure to check their automobile insurance policies and make sure that coverage for supplementary uninsured/underinsured motorist coverage–sometimes referred to as “SUM” coverage–was equal to the amount of liability (bodily injury) coverage. I have always thought that SUM coverage is one of the most important types of coverage included in your policy because that is the coverage that will compensate you (and members of your family) for injuries you sustained by a negligent driver with insufficient insurance.

In New York, drivers are only required to have $25,000 in bodily injury coverage. Bodily injury coverage is the liability insurance that pays when a driver negligently causes injuries to another party. Sadly, many drivers only purchase the minimum. This is probably one of the ways that 15 minutes can save you 15% or more on car insurance.

If you are seriously injured by the negligence or carelessness of one of these underinsured drivers, your own SUM coverage could be available to compensate you for any injuries sustained that are above and beyond the insurance carried by the negligent driver. But, that requires you to have adequate SUM coverage too.

Unfortunately, there have been a number of occasions when we have had clients suffer devastating injuries after being struck by a negligent driver carrying only the minimum amount of bodily injury coverage, and we have had to explain to the client that there is little left for them to recover because our client carried a minimal amount of SUM coverage, even though the client in this case often had adequate bodily injury coverage insuring against their own negligence (which wouldn’t apply in this situation).

A good summary of how SUM works may be found by reading Auto Insurance Protection: the SUM of all fears. Over the years, we’ve written several posts about the importance of having adequate SUM coverage, and now we have some good news to report.

On December 18, 2017, the Governor signed a bill amending provisions of the Insurance Law to provide for increased SUM coverage. Starting with new policies issued after June 16, 2018, the amount of SUM coverage to be included in any auto insurance policy will be the same as the amount of bodily injury coverage selected by the insured. Although an insured may decline SUM coverage or purchase a lower limit, I do not recommend doing so. According to the sponsor’s memorandum:

Supplementary insurance, also known as uninsured or underinsured motorist insurance, protects motorists who suffer severe and devastating injuries in accidents with drivers who carry inadequate or no insurance. Few drivers are aware of the value of supplementary insurance and insurance companies rarely offer supplementary insurance coverage above the statutory minimum. This bill will ensure that drivers are fully protected themselves by supplementary insurance equal to the bodily injury liability insurance coverage they select to protect others, unless they affirmatively elect lower coverage for themselves.

If you or a family member are ever seriously injured in an accident caused by another person’s carelessness, you can always contact us to talk about your rights and available options. Information about our Personal Injury Practice may be found here. Hopefully, you’ll never need us for that.

Happy New Year!

Are Rochester Drivers Less Careful?

On my way in to work this morning, I passed a few heads of cabbage that remained along the shoulder of I-490 after an accident that happened a few days ago. In case you haven’t heard, it was all over the news (and all over the road!): thousands of heads of cabbage spilled all over both lanes of the expressway after the truck carrying them tipped over along a sharp curve. You can read about it here and see some more pictures here.

Anyway, on the heels of that incident, it probably should come as no surprise that a new report from Allstate Insurance Co. shows that Rochester drivers are less careful than last year. The Rochester Business Journal reported that:

The average driver in Rochester will experience a car crash every 7.7 years. By comparison, Kansas City, Kansas–ranked first in the report–drivers will experience an accident every 13.3 years. That is nearly 25 percent less likely than the national average of 10 years.

I guess it may be time for us all to take a defensive driving course again. But, sometimes, no matter how defensively we’re driving, an accident may be unavoidable. Tragically, serious accidents can sometimes be caused by judgment-proof drivers (with no assets), carrying either a minimal amount of insurance or no insurance at all. That is why I always tell my friends, clients and family members how important it is to have adequate “SUM” coverage. I’ve written about this before, and urge you to read these posts to find out more about this kind of coverage that you MUST have: Wrong-Way Crashes Highlight Need for Adequate SUM Coverage and Walkers, Runners, and Bicyclists: Tune Up Your Auto Insurance!

If you or a family member are ever seriously injured in an accident caused by another person’s carelessness, you can always contact us to talk about your rights and available options. Information about our Personal Injury Practice may be found here. Hopefully, you’ll never need us for that.

Safe travels!

Walkers, Runners, and Bicyclists: Tune Up Your Auto Insurance!

Has spring sprung in Rochester? On the way home, I heard there is a chance flakes will fly before the week is out. I think we’ve had enough flakes for a while. Let’s hope Mother Nature agrees!

If it is indeed springtime, we will all be happy to get outside and enjoy the weather. It’s time to dust off the old sneakers, and tune up the bicycle. But before you do so, I have some recommended reading for you.

One of my partners just wrote an excellent article on our firm’s website explaining why it is important to tune up your automobile insurance policy. Many people don’t realize that parts of your own automobile policy may cover you if you are a pedestrian (e.g., walker or runner) or even a bicyclist, and you are injured by a careless driver. This can be especially important if the negligent driver is either uninsured or carries only the statutory minimum amount of liability insurance.

Here is the link to the article: Walkers, Runners and Cyclists: Don’t Forget to Tune-Up Your Insurance!

Season’s Greetings and 2014 Preview from Rochester Law Review

Thank you to everyone who has paused to read an entry or two in my law blog this year. I am especially thankful for all of you who have subscribed to the blog, *liked* the blog’s Facebook page, followed me on twitter and connected with me on LinkedIn. I have also enjoyed writing these posts, and hope you have enjoyed reading them, and finding them useful and informative.

December has proved to be a tough time to keep up with the original posts. But don’t worry, I have a few posts in the works for January. One of the first posts I will write will be a follow up to the post I wrote about the horseback rider who survived summary judgment. As I noted in my earlier post, the court held that the waiver form signed by the rider did not absolve the ranch of liability. Are these waivers ever valid? Check back later to find out.

I also expect to write a little bit about our firm’s personal injury practice. We do not have any billboard advertisements, and we don’t have fancy jingles or rhyming nicknames. But, we do have experience, and we will be there if you or a loved one every needs us. Since our firm began in 1979, it has represented clients seriously injured by the negligence or intentional misconduct of others, whether involving motor vehicle accidents, product malfunctions, defective premises, construction site accidents, or other misconduct.

Finally, as the year comes to a close, I want to wish all my readers a Merry Christmas and a Happy New Year!

Wrong-Way Crashes Highlight Need for Adequate SUM Coverage

Sadly, for the second time in two weeks, an innocent driver was killed by a wrong-way driver on I-490 in Rochester. You can read about it here.

Although nothing can truly compensate the families impacted by this senseless tragedy, it is often the case that the wrong-way driver in these situations has only the minimum amount of liability insurance–if he or she has any at all. When that happens, the injured victims may be able to receive compensation from their own insurance policy under a provision known as Supplemental Underinsured Motorist or “SUM” coverage.

But, the tragedy may be compounded by the fact that an injured victim may only carry the minimum amount of SUM coverage. That is why I always tell my friends, family and clients how important it it to make sure you review your automobile coverage and make sure that you have an amount of SUM coverage equal to your underlying liability coverage. This is a part of your policy that you’ve probably overlooked, but it is perhaps one of the most important parts because it covers you in the event that you are seriously injured by a careless driver who has only minimal insurance.

Here is an article we wrote a few years back that explains how this coverage works. I urge you to take a look, and make sure that you have sufficient coverage.

Giddyup! Horseback Rider Survives Injury (and Ranch’s Summary Judgment Motion)

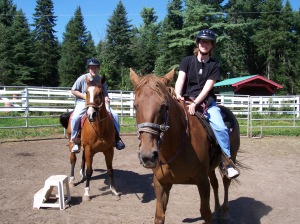

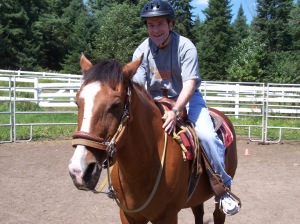

Year after year, no matter where we went for vacation, we always seemed to drive by a ranch offering trail rides. Finally, after many years of declining such requests, my wife finally convinced me to give it a try. We were vacationing in the Adirondacks and I owed it to my wife to finally give horseback riding a try.

Earlier in the week, I went overboard with the mountains we climbed–choosing in mid-hike to add another nearby mountain to our trek before returning to the car. Suffice it to say, this made it easier for my wife to convince me to finally go on my first trail ride.

While the trail ride proved to be a fun experience (and I’ve been riding a few times since then), I was pretty nervous about being that high up on unfamiliar trails. I also remember the guide giving us a short pre-ride lesson, and while he was sitting on his horse, it stepped back and tripped on the small step ladder he used to get on the horse. This only served to heighten my anxiety, as I already had Christopher Reeve on my mind, and now I watched our guide nearly fall off his horse. But we made it without any other mishaps.

By now, you’re probably thinking, “What does this story have to do with the injured horseback rider you mentioned earlier?” I am pretty sure that the ranch where I first rode was the Emerald Springs Ranch in Saranac Lake (how many other ranches could there be in Saranac Lake?). So when I saw a case about an injured horseback rider suing the Emerald Springs Ranch I knew I had to write about it.

In Vanderbrook v. Emerald Springs Ranch, 109 A.D.3d 1113, 971 N.Y.S.2d 754 (4th Dep’t 2013), the horseback rider sued the Ranch, seeking damages for personal injuries she sustained while riding a horse on a guided trail ride at the Ranch. During the ride, the horse brushed up against a tree, plaintiff was unable to push away from the tree, and the tree caught plaintiff’s leg, allegedly injuring her leg and hip.

The Ranch moved for summary judgment, asking the trial court to dismiss the complaint as a matter of law because, according to the defendant, the plaintiff could not establish either (1) the horse’s “vicious propensity” or (2) that the Ranch was aware of such “vicious propensity.” How could a horse have a vicious propensity? Should be pretty easy, right?

Not exactly. As the court noted, “It is well settled that the owner of a domestic animal who either knows or should have known of that animal’s vicious propensities will be held liable for the harm the animal causes as a result of those propensities.” [Vanderbrook, 109 A.D.3d at __, 971 N.Y.S.2d at 755 (internal quotations omitted)]. “[A]n animal that behaves in a manner that would not necessarily be considered dangerous or ferocious, but nevertheless reflects a proclivity to act in a way that puts others at risk of harm, can be found to have vicious propensities–albeit only when such proclivity results in the injury giving rise to the lawsuit.” [Id. (internal quotations omitted)].

In an effort to convince the court that the complaint should be dismissed, the Ranch submitted proof establishing that the rider herself testified that she was in fact instructed by Ranch personnel to push off the trees if the horse walked too closely to the trees on the single-track trail. The Ranch bolstered this proof with the transcript of the Ranch owner’s deposition, in which she also stated that she told her guides to instruct riders to push off the trees of the horses rode too closely to them. The Ranch obviously thought this proof would support its arguments. But the court instead found that this proof instead illustrated a question of fact to be determined at trial as to whether the Ranch knew of the horse’s propensity to walk too closely to the trees, which was the behavior that allegedly caused the rider’s injury.

The court also ruled that the Ranch failed to establish as a matter of law that the rider assumed the risk of horseback riding. “Assumption of the risk” is a defense often successfully asserted in recreational injury cases. However, as the court noted here, “Horseback riding participants will not be deemed to have assumed unreasonably increased risks.” [Id. (internal quotations omitted)]. According to the court, the Ranch’s evidence again raised questions of fact as to whether the Ranch unreasonably increased the risks of horseback riding by using a bitless bridle on their horses, which allegedly failed to provide plaintiff with the ability to control the horse, and by failing to give the plaintiff, who was a novice rider, adequate instruction on how to control the horse. When looking at the pictures of my first ride, I noticed that the bridle on my horse also appeared to be bitless.

Finally, the Ranch also sought dismissal of the complaint based on the waiver of liability that the rider signed before the ride. The court ruled that the Ranch failed to establish any entitlement to dismissal on this ground as well, finding that the release here was void as against public policy based upon General Obligations Law section 5-326. Although it is a common practice to ask participants to sign waivers like this before engaging in certain recreational activities, many (but not all) of these releases have been rendered void by this provision of the General Obligations Law. The issues presented by such releases are beyond the scope of this post, and I plan to write about that in a future post.

So what happens next? In all likelihood, the case will be scheduled for a trial. Although the injured rider survived the Ranch’s motion for summary judgment, this only means that she was able to convince the judge that factual issues exist, warranting a trial. Absent a settlement of the claim, she now must convince a jury that she is entitled to recover.

Court Dismisses Snow and Ice Slip and Fall Case

I just took the dog out, and discovered that it is snowing! Is it really that time of year already? I still have some leaves to rake. I guess I’ll have to put the rake away and get the shovel out.

Earlier today, I was reviewing recent decisions from the Appellate Division, Fourth Department, and I came across a case that I thought would be the good subject for a post coinciding with the first snowfall. I just didn’t think I’d be writing this post today!

The case of Glover v. Botsford, 108 A.D.3d 1182 (4th Dep’t 2013), was brought by a woman seeking damages for injuries she sustained when she slipped and fell on snow or ice on the sidewalk in front of a store owned by one of the defendants and operated by another within the City of Rochester. The plaintiff alleged that the defendants were negligent because they either created the dangerous condition outside of their store or failed to remedy the condition despite actual or constructive notice of it. Following discovery, the defendants moved for summary judgment, seeking dismissal of the complaint. The defendants alleged that they had no duty to remove the snow and ice from the sidewalk because there was a storm in progress at the time of the accident. However, Justice Polito denied the motion, having determined that there was an issue of fact as to whether the defendants “properly maintained the dangerous, slippery condition by removing the snow, but not salting or removing the ice, as alleged.”

The Appellate Division reversed, based primarily on the affidavit of defendants’ expert meteorologist, and the weather reports upon which that expert relied. According to the court, this evidence established as a matter of law that there was a storm in progress at the time of the accident.

In opposition to the motion, plaintiff relied exclusively on an affirmation from her attorney, “who asserted, based on an inaccurate reading of the weather reports submitted by defendant that it was not clear whether it had been snowing at the time of the accident.” Parenthetically, I note that earlier today I read a post on the American Bar Association website, discussing a case by U.S. Court of Appeals Judge Richard Posner, who heavily criticized attorneys for being “afraid of math” and the sciences, and one wonders if this case provides further evidence in support of Judge Posner’s argument?

In any event, the Fourth Department noted that:

Even assuming, arguendo, that it was not snowing heavily at the time of the accident, we note that the ‘storm in progress doctrine is not limited to situations where blizzard conditions exist; it also applies in situations where there is some type of less severe, yet still inclement, winter weather.’

The court also noted that the plaintiff failed to establish that there was any sort of “lull” or “break” in the storm such that the defendants would have had a reasonable amount of time to abate the slippery conditions.

The court also held that the plaintiff failed to raise an issue of fact as to whether the defendants created the dangerous condition or whether their snow removal efforts made the condition worse. The court noted both that:

- The mere failure to remove all snow and ice does not constitute negligence and does not constitute creation of a hazard; and

- The failure to salt or sand a sidewalk does not constitute an exacerbation of a dangerous condition.

Cases like this can be challenging, and not every accident is the result of someone else’s negligence. However, if you or a loved one are seriously injured and have questions about whether or not a claim exists, feel free to contact me. Since its founding in 1979, our firm has represented many clients who were seriously injured by the negligence or wrongful conduct of others. We would be happy to help you.